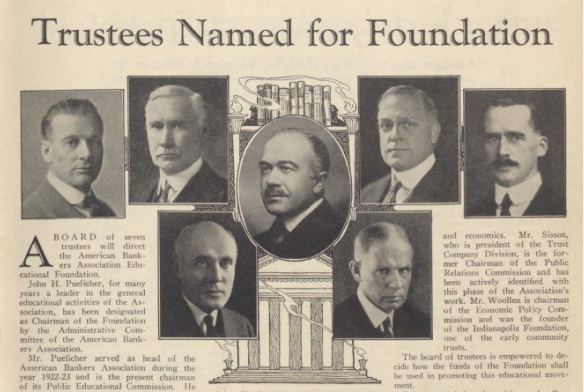

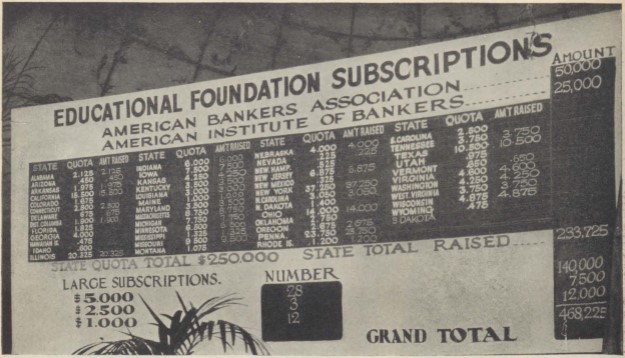

1925

The Foundation for Education in Economics Trust Fund was created to commemorate the 50th anniversary of the American Bankers Association. Funded through voluntary contributions, the trust fund sponsored college scholarships and research grants in economics, banking and finance.

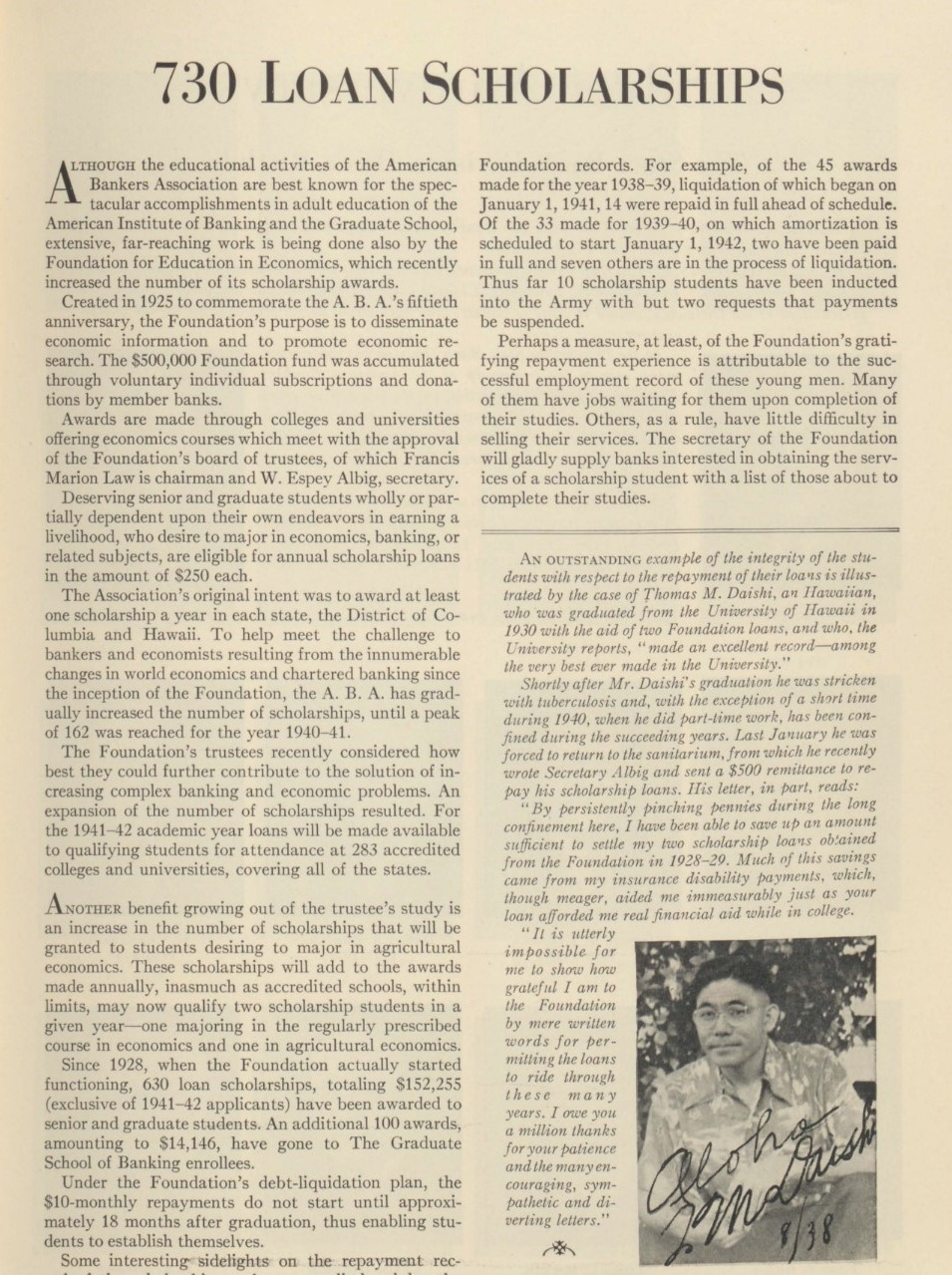

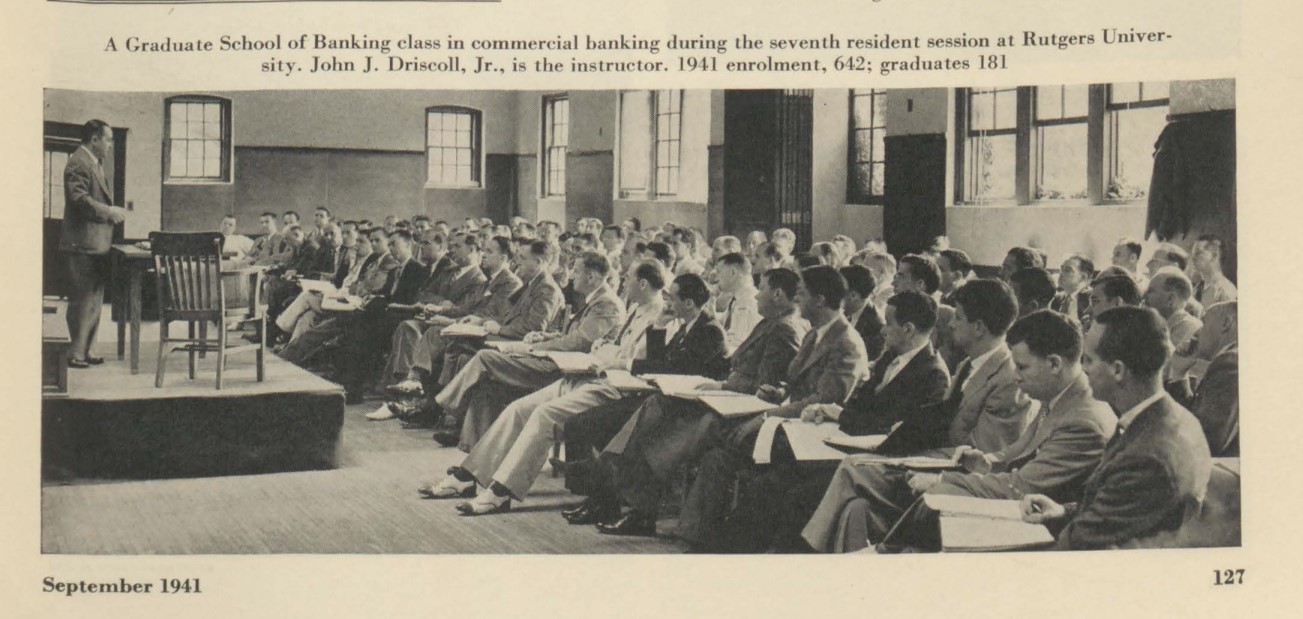

1941

The Foundation for Education in Economics expanded to 730 the annual number of loan scholarships awarded to college and university students.

1971

The Personal Economics Program (PEP), the foundation’s first consumer program, was implemented to help volunteer bankers make financial education presentations in their local schools and communities.

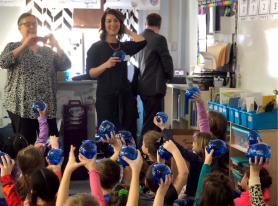

1997

Teach Children to Save Day was created to help kids in grades K-8 learn how to save money and make sound financial decisions. The foundation’s longest-running financial education program is celebrated on the fourth Thursday in April.

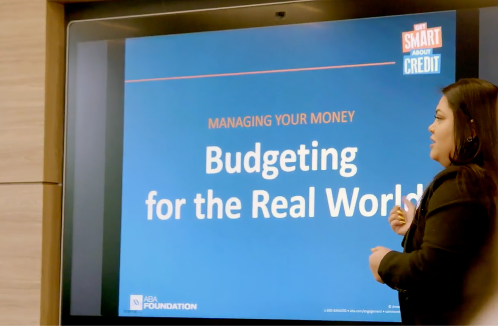

2003

Get Smart About Credit Day was created was created to help teens and young adults navigate their finances as they go through college and enter the workforce. The program is celebrated every third Thursday in October.

2010

The Lights, Camera, Save! contest was launched to give teens a chance to show off their creativity and financial know-how. Banks host local contests to pick a winner, who then competes for the grand prize at the national level.

2012

The Community Commitment Awards were established to recognize the extraordinary acts of service banks perform in their communities. Banks are honored in seven different categories, including affordable housing, community & economic development, financial education, economic inclusion, protecting older Americans, supporting military families and volunteerism.

)

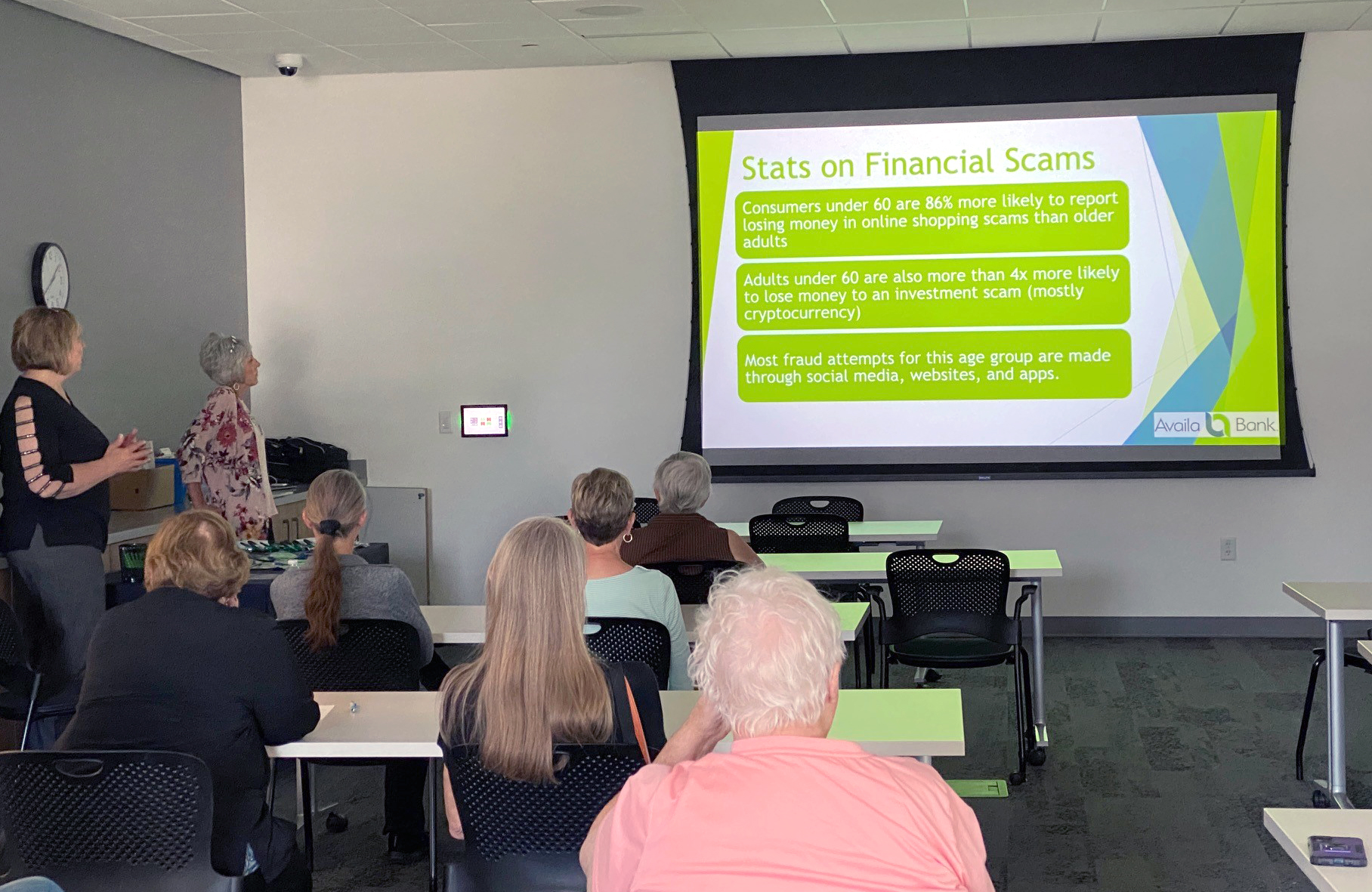

2016

Safe Banking for Seniors was created to help seniors and their families recognize scams, prevent elder financial exploitation, and navigate needing/becoming a financial caregiver.

2020

The foundation’s Disaster Response program was created to help state banking associations recover following presidentially declared disasters. Each association can request fundraising assistance for designated 501(c)(3) charities.

2024

The foundation launched its Unlocking Homeownership campaign to equip banks of all sizes with the training and resources to help their customers and communities achieve sustainable homeownership. The program also aims to boost homeownership education and counseling.

The story continues

The story continues